Hakka Harvester

Born For Chad Hakka Farmers: An Alternative to Ape in Yield Farming

Background

Why Hakka Harvester

Since Compound Finance released its liquidity mining program, throwing back in February 2020, yield farming has become the rocket fuel of DeFi as well as attracting a load of users on Ethereum network.

Nevertheless, to participate in this party, it would take a lot of effort for each individual to locate nice liquidity mining pools with ideal APY. What’s more, people might find it hard to evaluate the intrinsic value of each protocol and its token. It has always been a tough decision whether to sell or hodl.

On the other hand, a dilemma has been troubling us for a little while. For those who strongly believe in Hakka Finance and show great interest in holding HAKKA for the long term, they might find out that farming pools in other protocols might provide a better APY than our own mining programs. Therefore, they might end up acquiring more HAKKA if they go farming in other protocols and acquire $HAKKA with their crops. This phenomenon is especially observable on Binance Smart Chain due to the shocking farming APYs of major protocols.

Therefore, we have come out with an alternative for the above issues: Hakka Harvester.

Hakka Harvester: Born For Chad Hakka Farmer

Hakka Harvester can be regarded as an “aggregator” for those who are chasing farms with high-APY and show more willingness to hold $HAKKA instead of other protocol tokens. We will keep on searching and updating the latest liquidity mining pools with satisfying APY throughout the DeFi universe and pick out some potential liquidity mining pools and list them on Hakka Harvester.

Investors may access and join these cutting-edge liquidity mining pools on Hakka Harvester.

Features

Hakka Harvester is a yield farming portal providing a good user interface as well as guidance to acquiring specific farming tools. It would save a lot of time-consuming tasks for users (as farmers) to complete the complicated process of farming.

Moreover, Hakka Harvester solves another issue: “crop’s price fluctuation” by crowdsourcing the process of exchanging the crops into $HAKKA, which is averaging the dollar cost of selling the crops and buying $HAKKA. Farmers in Hakka Harvester may end up suffering less price fluctuation and securing the actual displayed APY.

Additional Benefits

What’s next, to compensate opportunity cost of capital participating in Hakka Harvester, we will provide additional $HAKKA rewards proportionally, which means that people who join liquidity mining pools via Hakka Harvester would actually enjoy a higher APY than farming directly in those pools.

How to join Hakka Harvester

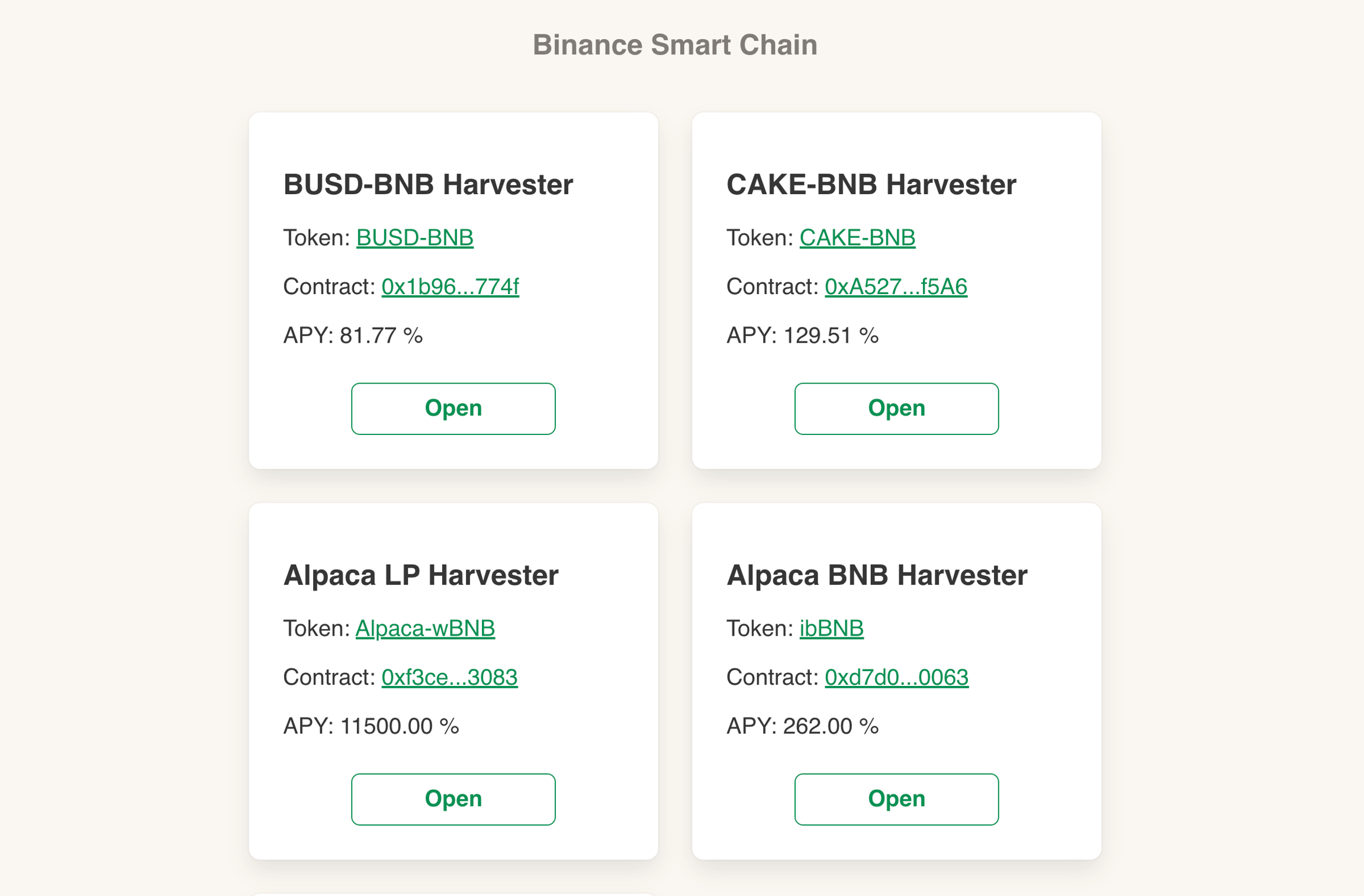

On https://harvesters.hakka.finance/ , there will be a variety of handpicked liquidity mining pools. We will display the real-time APY and the exact farming implements required in each pool. You may choose your favorite pool and prepare the corresponding farming (LP) token.

*Remember to switch to “Binance Smart Chain” Network

Let’s take the “BUSD-BNB Harvester” pool, for example, to participate in this pool and enjoy an 81.77% APY, you have to prepare “BUSD-BNB CAKE-LP Token”.

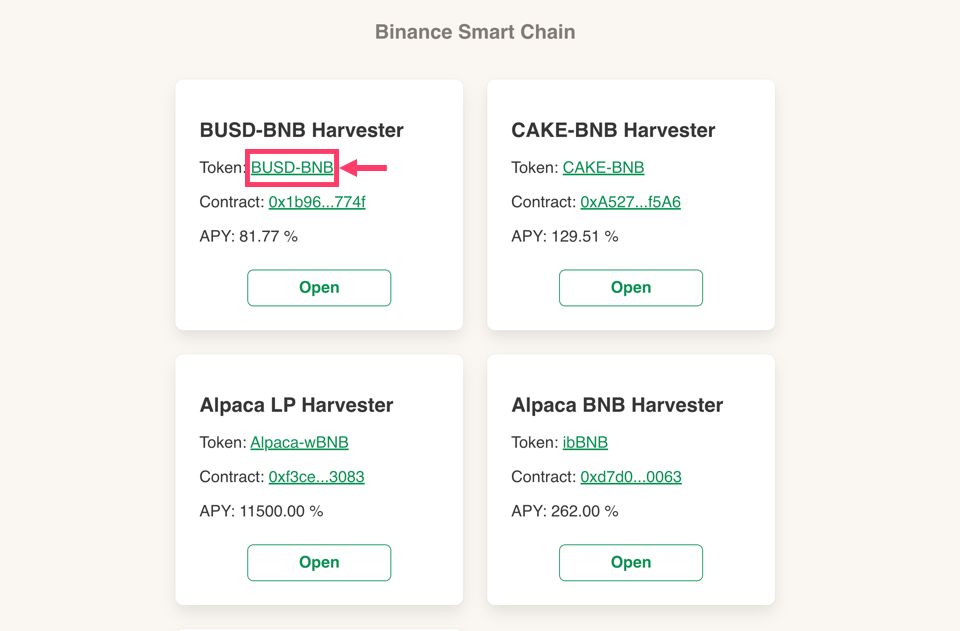

By clicking the “BUSD-BNB token label”, you will be led to the page where you can acquire the farming tools in that liquidity mining pool.

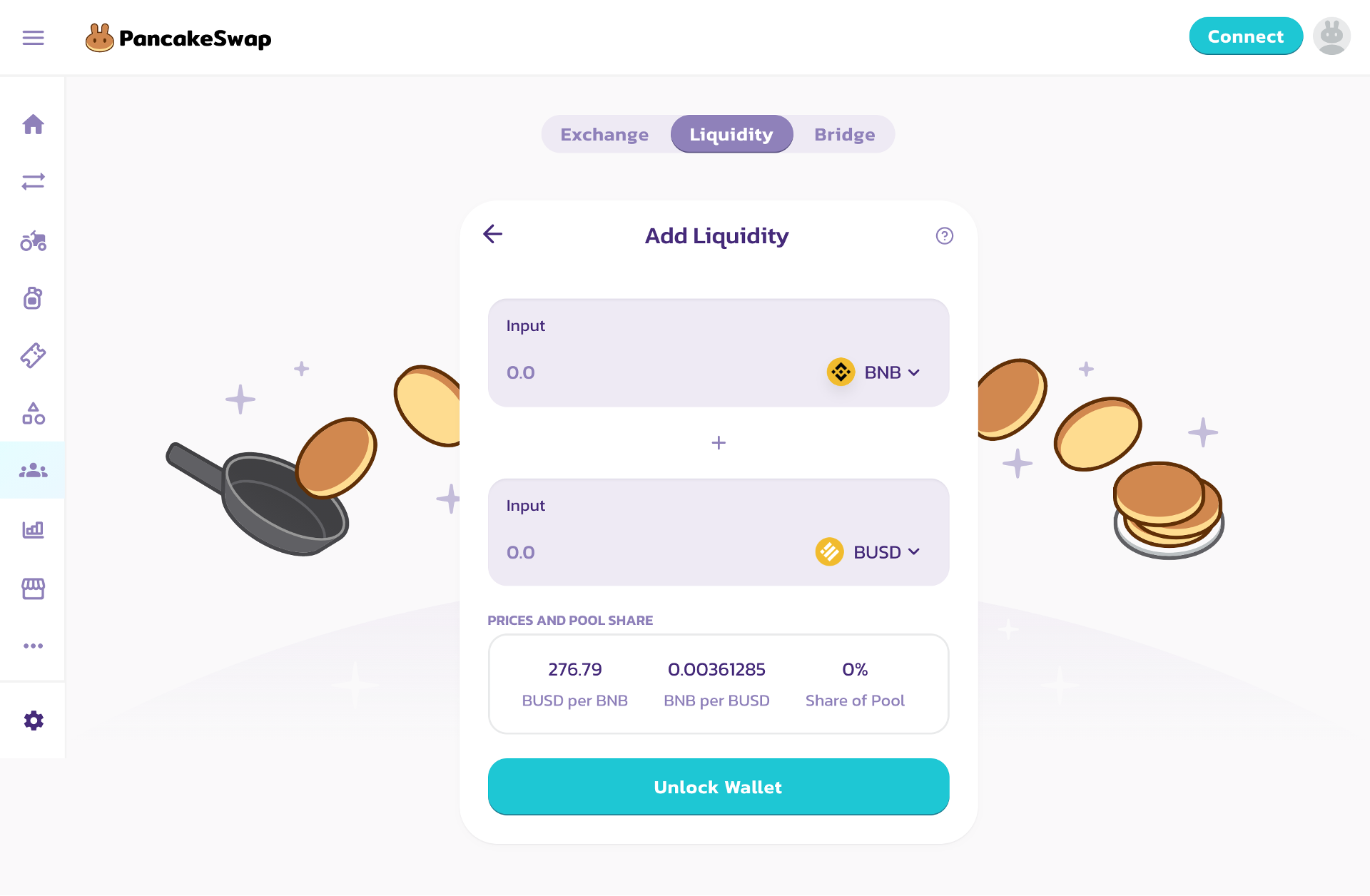

You may provide liquidity with BNB and BUSD in PancakeSwap to acquire the BUSD-BNB CAKE-LP token.![]()

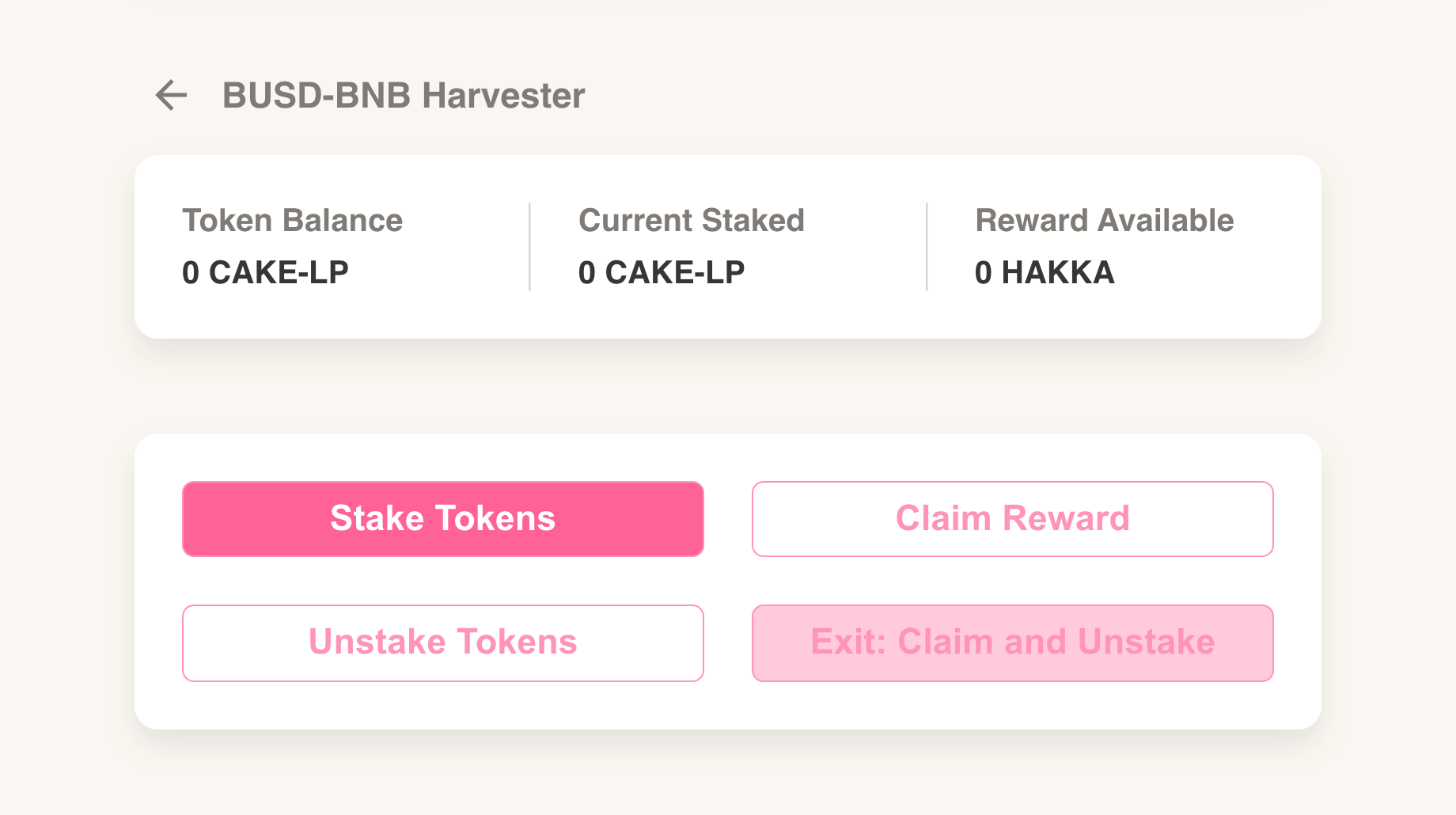

After providing liquidity and acquire the LP token, you may go back to Hakka Harvester and stake the LP token.

Once you staked the LP token, you are successfully participating in Hakka Harvester. You may see Hakka rewards showing up on the page. 😎

Disclaimer

Hakka Harvester is a slapdash tool built for the Hakka community. We will be as careful as we could in choosing the best farming pools. However, we do not guarantee that these pools and all the underlying mining contracts (the actual sources of yields) are 100% safe. The harvester contract isn’t audited and will never be audited. Please do your own research before participating in farming in each Hakka Harvester pool.

VestingVault

VestingVault contract will also be implemented in Hakka Harvester.

With VestingVault contracts, HAKKA rewards will be distributed under the terms:

Withdrawal is available once per 19 days.

17.38% of the vesting balance can be withdrawn in each withdrawal.

Implementing this feature can stabilize the supply of HAKKA. The rewards release will be smoother and minimize the impact on the token circulation.

For more details about VestingVault Contract, please refer to Vesting Contract

Vesting ContractLast updated